Views on supply chain visibility

There is a growing need for supply chain visibility, but in what form? Do companies need visibility of the inbound, outbound and/or internal supply chain? And who has full end-to-end supply chain visibility extending beyond their tier one suppliers? Husqvarna, Henkel and Alpro share their insights in this article.

By Marcel te Lindert

The demise of the Lehman Brothers financial institution has fundamentally changed the face of supply chains. Trends such as globalization and e-commerce have significantly increased complexity and unpredictability, and supply chains have lost all their buffers as a result of the financial crisis. That has created major challenges, especially in combination with the growing international tension caused by the new trade barriers imposed by the likes of the USA and China and the currency devaluation in emerging economies such as Turkey and Argentina. How can we prevent an incident in one link in the chain affecting the whole process? The answer: visibility.

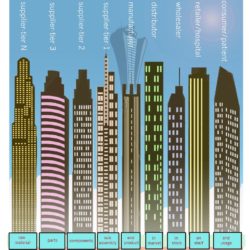

Visibility is one of the most commonly used words in a supply chain context, but the precise interpretation of visibility differs from one company to another. Whereas one company might invest in visibility for its inbound supply chain, another might focus on the outbound supply chain – and many organizations are still struggling to gain visibility of the internal supply chain. In fact, companies like Unilever use three different control towers: one for each part of the supply chain.

Another difference relates to the level of visibility. Some companies are looking for visibility at the operational level (where are my goods?), others at tactical level (what is the customer demand?) and others at strategic level (how financially robust are my suppliers?). But who has full end-to-end supply chain visibility – from the production of raw materials to the usage by consumers – at operational, tactical and strategic level?

Weather and climate

Husqvarna’s need for visibility is primarily focused on the strong seasonal nature of its business activities. The international company, headquartered in Sweden, manufactures and distributes products including forestry and horticultural equipment, irrigation products and building tools. Around 70% of its sales activities are concentrated in the first half of the year, when professionals and gardening enthusiasts invest in a new Husqvarna lawnmower and consumers decide they need a Gardena sprinkler system.

“This peak is different from the retail peak that occurs around the time of Black Friday or Christmas”, says Valentin Dahlhaus, Senior Vice President Group Operations at Husqvarna. “The exact timing and size of our peak depends mainly on the weather and climate. Our need for visibility is primarily focused on questions such as: what is the customer demand, where will it occur, what is the product offering and which inefficiencies are preventing us from achieving high service levels and high inventory turnover rates?” … … …

Want to read more?

Subscribe on iPad or Android tablet to read the full version >>

or

Subscribe on print to receive the next issue >>

This article was first published in Supply Chain Movement 31 | Q4 – 2018