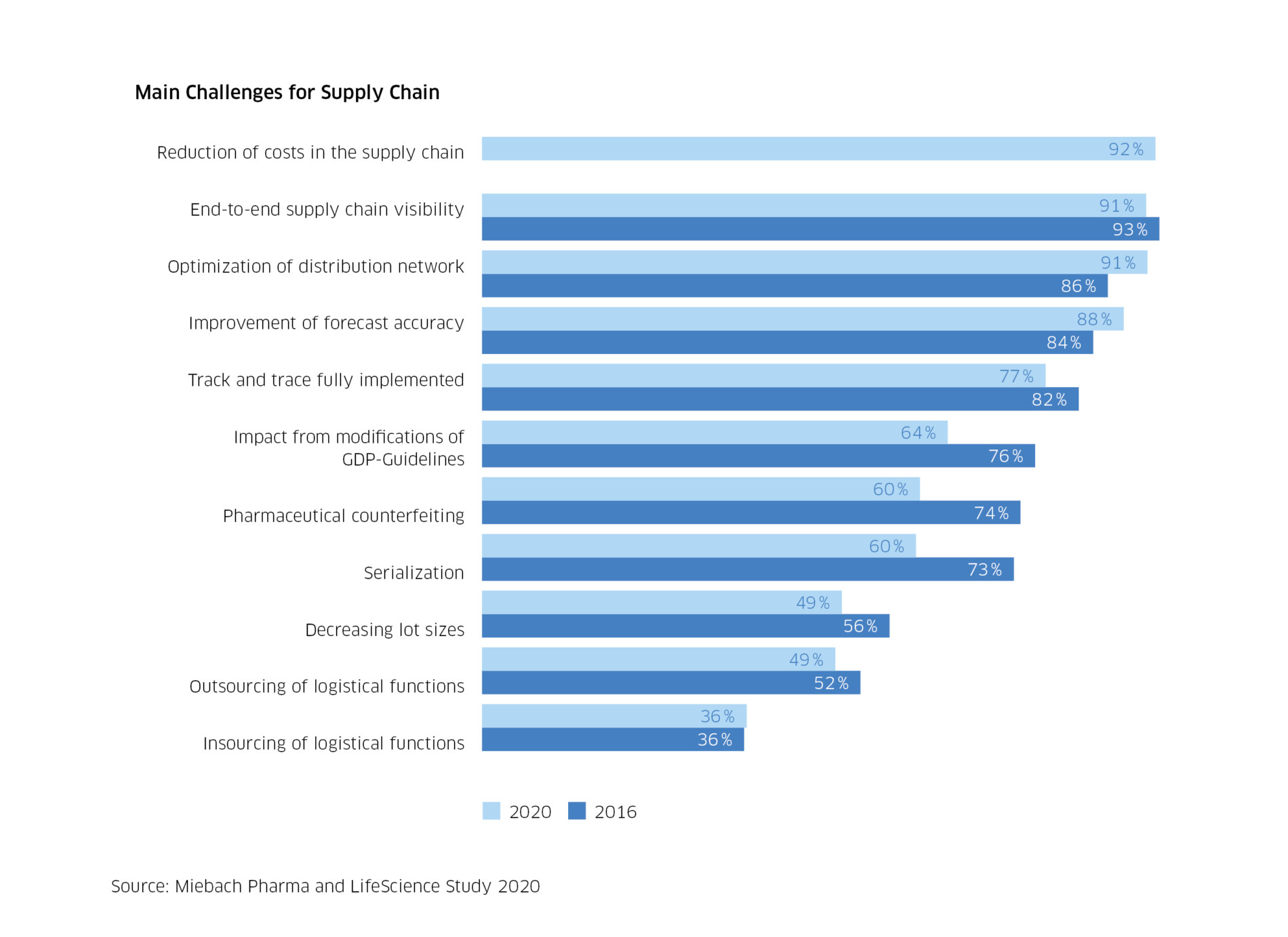

Even the pharmaceutical industry can no longer escape cost pressure

For many years, the pharmaceutical industry has not had to worry about supply chain efficiency thanks to sky-high margins. That period is now over, concludes consultancy firm Miebach on the basis of its ‘Pharma and Life Science Study 2020’. Reducing supply chain costs is now at the top of the agenda. Above all, this requires a digital transformation – and that’s likely to be quite a challenge in the pharmaceutical sector.

By Harm Beerens

As growth rates slow, lucrative drug patents come to an end and governments and insurers increase the price pressure, reducing supply chain costs is suddenly a top priority for pharmaceutical companies in order to maintain profit margins. “Actually, pharma is now entering the phase in which other sectors such as fast-moving consumer goods, high-tech and retail have been for years,” says Miebach’s pharma expert Martin Eckert (pictured) during the official presentation of the findings on 6 May. The study asked executives from 450 pharmaceutical companies around the world about their supply chain management challenges and priorities.

Goods flows under control

When asked how companies intend to reduce costs, most companies mention end-to-end visibility, optimizing distribution networks and improving their forecast reliability. Eckert agrees that huge savings can indeed still be achieved in this way: “We work with virtually all the major producers in the world and what is striking is the enormous complexity of their supply chains. They are highly globalized companies, with numerous factories and warehouses all over the world. Getting tighter control of goods flows and speeding up your responsiveness to incidents thanks to better visibility enables you to achieve major cost reductions. In addition, you will need much less safety stock if you improve your forecasting and process reliability.”

In order to realize all this improvement potential, it is necessary for the pharmaceutical industry to undergo a digital transformation, Miebach’s experts conclude. Control tower-like systems can only provide optimal control and coordination when all the supply chain partners involved are connected via the cloud. Based on all the data that becomes available, artificial intelligence can reveal new patterns as the basis for smarter decision-making.

Master data is the biggest challenge for pharma companies

One potential problem lies in the fact that everyone in the chain has to work with the same, unambiguous figures. 95% of the companies surveyed currently regard master data management as the most important challenge. Eckert: “In the pharmaceutical industry, every department still works with its own figures. One department calculates in terms of boxes, another in pallets, another in euros… It won’t be easy to get them all on the same page. It calls for a different mindset, and that’s much more difficult to achieve in practice than the implementation of a new IT system.”

COVID-19 will lead to wave of insourcing

What about the coronavirus crisis? Isn’t that a much bigger challenge right now? Eckert: “I should point out that the research was conducted before the COVID-19 outbreak. I think it’s obvious that the results would have looked different if we had done the survey in April.” According to him, risk management and business continuity would have been at the top of the list in that case. “Certainly in the pharmaceutical industry, companies are now discovering that globalization also has a downside. In order to reduce availability risks, I expect that we will experience a whole wave of insourcing in the near future. Companies will also start producing more locally. That doesn’t seem like a bad idea to me, especially for producers of life-saving medicines.”

These are the main supply chain challenges in the pharmaceutical industry in 2020 compared to 2016: