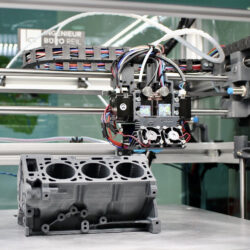

Manufacturing companies struggle to adopt and scale up 3D printing

Manufacturing companies recognize the benefits of 3D printing, but face challenges when adopting and scaling up the technology for high-volume production. This is the key finding from research by Materialise. The study reveals that companies regard 3D printing as an important manufacturing trend and are exploring the strategic use of this technology. However, the shortage of skilled workers and a lack of the necessary expertise to integrate printing into existing production processes can slow down its adoption.

The survey was conducted among 327 manufacturers in Germany, Japan and the USA. Respondents included a mix of companies already using 3D printing (59%), considering the technology (31%) and dismissing it (9%). According to Materialise, the 3D printing industry has focused on convincing companies of the technology’s unique advantages in recent years. That focus on the ‘why’ will now shift to the ‘how’ because manufacturers are familiar with the benefits, but still lack the knowledge and expertise to successfully adopt and scale up the technology.

“Years of sustained supply chain disruptions have caused companies to reevaluate their offshore manufacturing strategies and prioritize local production, closer to the demand,” comments Fried Vancraen, CEO of Materialise. “The severity of these disruptions has also prompted governments to invest in programmes aimed at modernizing and nearshoring the manufacturing capacity. Digital manufacturing technologies such as 3D printing can support these efforts by enabling more resilient supply chains and providing significant advantages in terms of time and cost.”

Important tipping point

3D printing is increasingly being used to create finished products. In fact, prototypes and finished products now each account for approximately half of all 3D printed parts, which marks an important tipping point in the use of the technology. However, the study shows significant differences by country: printing is used to make finished products by 60% of respondents in the USA, compared with 43% in Germany and only 36% in Japan. This hesitance may well put Japan at a disadvantage as other manufacturing regions continue to embrace digital manufacturing technologies such as 3D printing.

Companies that are already using the technology see many benefits of 3D printing, particularly the ability to speed up production, create low-cost prototypes, reduce supply chain dependency and mass-customize finished products. Nevertheless, nearly all companies (98%) experience challenges and barriers to adopting 3D printing. Although they are convinced that printing can generate business value for them, they are struggling to adopt the technology and scale up production. This indicates a significant shift in the discussion from the ‘why’ to the ‘how’.

Lack of skilled workers

The biggest challenge facing companies that have already adopted or are considering adopting 3D printing is the difficulty in recruiting skilled workers (36%). This is followed by the lack of experience and knowledge within their company (33%). Other challenges include the speed of printing for high-volume production (23%) and difficulties in integrating printing with existing production technologies (20%). Both operating costs (25%) and equipment costs (25%) are also mentioned as barriers.

“Major manufacturing regions, including the EU and the USA, have announced plans to modernize and reshore production,” states Vancraen. “Smart, digital technologies such as 3D printing enable such a shift to decentralized manufacturing based around multiple small production sites closer to customers. But since companies are struggling to adopt 3D printing and integrate the technology into existing manufacturing environments, this industry will need to invest in training, material availability, ease of use and cost reduction.”

Increasing usage

Despite the challenges, 3D printing remains high on the list of priorities for most respondents. Companies that have already adopted the technology have prioritized it in terms of budget (78%) and management buy-in (78%) and say they will significantly increase their usage over the next 12 months, with 46% of users indicating that their usage will at least double. Over the next five years, most expansion efforts will focus on in-house printing capabilities (71%), while outsourced 3D printing production scores just 8%.

Manufacturers do not expect to dramatically change the way they use printing over the next five years. Seven out of 10 companies currently involved in 3D printing say their usage is expected to remain the same, including for the production of visual prototypes, personalized items and spare parts. However, as the 3D printing workflow becomes increasingly automated and access to qualified experts improves, printing will be a dependable source of new business opportunities for companies looking to expand their manufacturing operations, according to Materialise.

Self-assessment tool

To help businesses successfully implement 3D printing, Materialise has developed a tool that determines a company’s level of maturity. It is useful for companies wondering how printing can support their production activities, as well as those that are ready to scale up their existing printing operations. The self-assessment tool is available at mtls.am/am-assessment.