‘Dining in the dark’ of supply chain risks

I’ve always wanted to try the ‘dining in the dark’ concept, so when I saw an advertisement for a pop-up ‘dining in the dark’ event in my hometown I jumped at the chance to make a reservation. This set me thinking about the parallels with supply chain management, since I’m currently doing a lot of work related to risk assessment and matching global risk with future supply.

By Heidi Larsen

Right now, we have no sight of even near-placed supply chain ‘challenges’ – or you could say we don’t know if we are about to spill our wine over the main course, let alone if the ‘seasonal greens’ will surprise us. In these times of multiple crises, many companies are steering blind because they are no longer able to stick to the envisaged roadmap or strategy.

The World Economic Forum Global Risk Report 2023 came out in January. This publication always attracts my attention, but this specific edition made me block my weekend and take an immediate deep dive. Ever since I started working with in the area of strategic and global supply chain in 2006, I have argued that supply chain should be introduced into the company’s value chain as early as possible so that it can create the best possible value and results for the company. It should have strategic importance and receive board-level attention to enable the shift from constant fire-fighting to building a sustainable, scalable and flexible supply chain fit for future growth. And now there it is in black and white in the Global Risk Report at long last: strategic supply chain is now the biggest risk in the near future.

Alternative leverage

The entire risk discussion taps into the very essence of my passion within supply chain: how will your supply chain look in three years from now in terms of commodities, products, functions or logistics? And if you should need to develop a strong and committed partnership with a new supplier in a new commodity, how will you make yourself attractive without being able to send an official purchase order? If you cannot build your relationship on financials, what else can you use as leverage?

The near-future and longer-term risks listed in the Global Risk Report are not surprising. The biggest-rated risks are those that can be felt immediately and that have a direct immediate impact on business, such as the rising cost of living and geopolitics (leading to suppliers’ price increases and higher freight charges).

However, at the companies I work with, the biggest short-term risk is the stock level. This relates to liquidity and free capital that is needed to fund company growth because, these days, equity is mostly found in boxes in the warehouse. This is a direct result of market shortages and longer lead times in both production and freight. But have we then built our supply chain (i.e. relationships) to survive the short-term decrease in order volumes, and could it be scaled up when the market takes off again in Q4 as most financial gurus predict?

Inventory challenge

In my work as a non-executive board member and strategic advisor, I am involved in strategic supply chains across industries. And the challenge of stock levels is ubiquitous, regardless of size, field of business and operating model. Based on analysis of the global freight market of 2021 and forecasts from 2022, warehouses are now holding three times as much inventory. A natural result of this is a greater focus on the finances, and this in turn impacts on relationships with suppliers. Budgets and growth rates have been revised for 2023 – and once again, the relationships with strategic suppliers are now where strategic competitive edge can be found and built.

“Strategic supply chain is not some theoretical approach – it is core business. We only have eyes for two things in supply chain right now: warehouse levels and supplier relationship management. The latter is what really makes the difference in creating value and flexibility for our customers in the global wind industry”, says Ann Bokkenheuser. She is CEO of Rose Holm A/S, a Danish SME that has been specialized in manufacturing high-quality fastener steel solutions for globally leading companies since 1953. Rose Holm has long-time partnerships with companies within the international wind and plate heat exchangers (PHE) industries. With three highly automated production plants (two in Denmark and one in the USA) combining deep-seated technical know-how with robots and digitalization, productivity and supply chain are among the key strategic factors in establishing and enhancing a strong position in the world market. Luckily for Rose Holm, it is focused on one single commodity: steel.

Companies active in multiple commodities are currently struggling to finance future growth. I recently spoke to a CEO in the global home décor industry, who told me that the next two months will determine whether their business should be scaled down. This once again illustrates that a scalable and flexible supply chain is not something to build in the future; it is necessary now to ensure continuity.

Today more than ever, relationships and partnerships could be a game-changer or deal-breaker, especially small and medium-sized growth companies. When business potential is being evaluated at board level, a degree of uncertainty is added to the ‘supply chain relationship formula’ every time the word ‘new’ is used, creating higher demands for a focus on supplier relationship management. This is further intensified in a time of multiple crises and uncertainty. It is not necessarily easy, but I see more and more examples of relationships winning over finances in negotiations and deliveries worldwide.

Strategic questions

So how can you lower your risk and build a strategic supply chain that is fit for the future? I would recommend that you discuss at least some of these questions at board level:

- What will be our core products in 2-3 years?

- Will we need more capacity or new commodities?

- Which part of our business is world-class? Which elements are most important to us?

- Should we focus on price, cost or near-sourcing?

- Will our customers and end-consumers change? And if so, how?

- Will new business come from existing customers, new markets or perhaps a mix of both?

- How will we fund our growth in the short term?

- Will our main priority be to bring down warehouse levels? And if so, what is our exact need for flexibility from our suppliers?

Uncertainty (i.e. risk) will increase in correlation with how many times you add the word ‘new’ to the strategy. And different types of ‘new’ will call for different strategies, which will all be impacted by the relationship with the supplier and the financial resources available.

I recently made a detailed overview of different strategies in relation to the intersection between relationship and finances. But a simple way to start the risk assessment is to list your current risks and divide them into two categories: what would potentially be challenging, and what would potentially close your company. Additionally, I think we can draw some parallels between how companies are affected by overall market impact (i.e. crises) and personal behaviour. When we are in balance, we act as our best selves and reach out in terms of questions. When we are drained of energy, we are too busy to ask for help and become somewhat blinded by the immediate challenge. This is why it is important for companies to be able to seek guidance from a board of directors or trusted advisors in times of crisis.

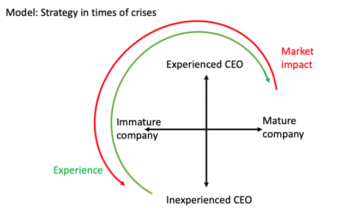

When a company is impacted by crises, the experience of the CEO or top management will determine its resilience and thereby its success. On the other hand, in times of calm waters, immature companies will become more mature over time, and inexperienced CEOs or senior executives will build specific know-how and experience within their particular company. This will better equip them to take care of the day-to-day management in times of crisis.

I have found it quite useful to reflect on the quadrant or mix of the company. When daily business deviates from the strategy, I often find that this is caused by times of crisis, or at least by the impact of the market. One could argue that the frequency of the strategy updates is higher in the bottom-left quadrant than in the top-right one, where a mix of experience and datasets will give grounds for a more far-sighted strategy.

When we have clear sight of short-term goals, the next challenge is to strike the right balance between core business and growth, and to find suppliers and business partners that can offer scalable and flexible solutions. This is an ongoing debate that can be adjusted to the current market situation. But strong and committed partnerships with the correct and true suppliers are essential for a strategic supply chain that is fit for future growth.

Map of tableware

I won’t be able to see what I’m eating when I go ‘dining in the dark’. I might spill my wine over the main course, lose track of where I placed my fork or perhaps even try to take a sip of my side salad. But am I happy to be taken by surprise by whatever is served up, or do I prefer to ask about the menu beforehand? Do I just accept having to hunt for my fork, or shall I try to make a map of the tableware in my head? My point is that, as with most things in life, I have a choice. The more I think about how to approach the future challenges while the lights are still on, the better prepared I will be for my ‘dining in the dark’ experience.

Heidi Rosendal Larsen is a professional non-executive board member and strategic advisor on international business strategy. She has a background in supply chain and innovation and has built up broad international private-sector experience since 2006. She is a regular keynote speaker and author on strategic supply chain topics from a board-level and senior-management perspective.